Practice Evaluation and Advisory Service

Independent, buyer-side advisory support for dentists evaluating practices and preparing to purchase.

Engagement Fee: $9,995

Engagement Length Up to 12 months

Comprehensive clinical, operational, and transaction support designed to help buyers make confident decisions before committing to a purchase.

What This Service Provides:

The Practice Evaluation and Advisory Service is a full buyer-representation engagement for dentists who want experienced, independent guidance while evaluating and purchasing a dental practice.

Unlike brokers, lenders, or seller-aligned professionals, our role is to represent the buyer’s interests exclusively. Our work focuses on identifying risk, validating assumptions, and helping you make informed decisions before entering a transaction.

This engagement is designed to support you through the evaluation, negotiation, and due diligence phases of a purchase, with advisory guidance through closing.

Core phases of support:

Financing & Closing Readiness

Clarity around financing options, loan terms, and the closing process so you understand cash-flow impact, obligations, and next steps before ownership begins.

Practice Evaluation

Independent clinical, operational, and financial evaluation to understand how a practice is likely to perform under your ownership.

Negotiation Structuring

Buyer-side guidance on pricing, offer structure, and key LOI terms so you know what matters, where leverage exists, and which assumptions need protection before making an offer.

Verification (During Due Diligence)

Support during the diligence period to confirm that the assumptions behind the offer hold up in the real world, including site-visit guidance and interpretation of findings.

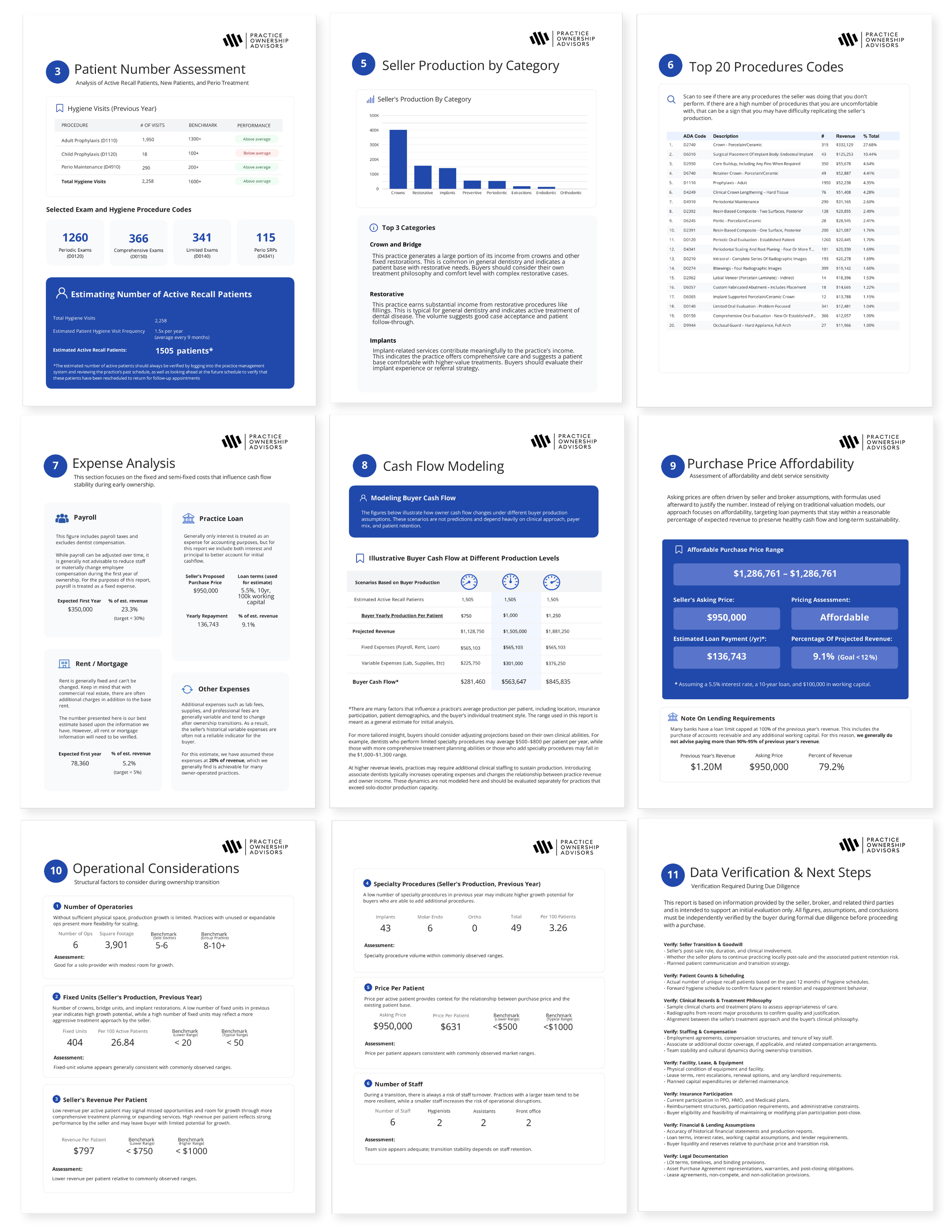

Detailed Practice Evaluation Report

The images below show selected pages from a sample Practice Evaluation Report. The full report includes additional analysis, findings, and supporting detail tailored to each buyer and practice.

What you receive:

Every evaluation culminates in a comprehensive Practice Evaluation Report prepared specifically for the buyer.

The report integrates clinical, operational, and financial analysis into a single, buyer-focused framework designed to answer one question:

How is this practice likely to perform for me as the owner?

All findings are documented clearly, with assumptions and risks explicitly identified, so buyers can move forward with confidence, or step away before making an irreversible commitment.

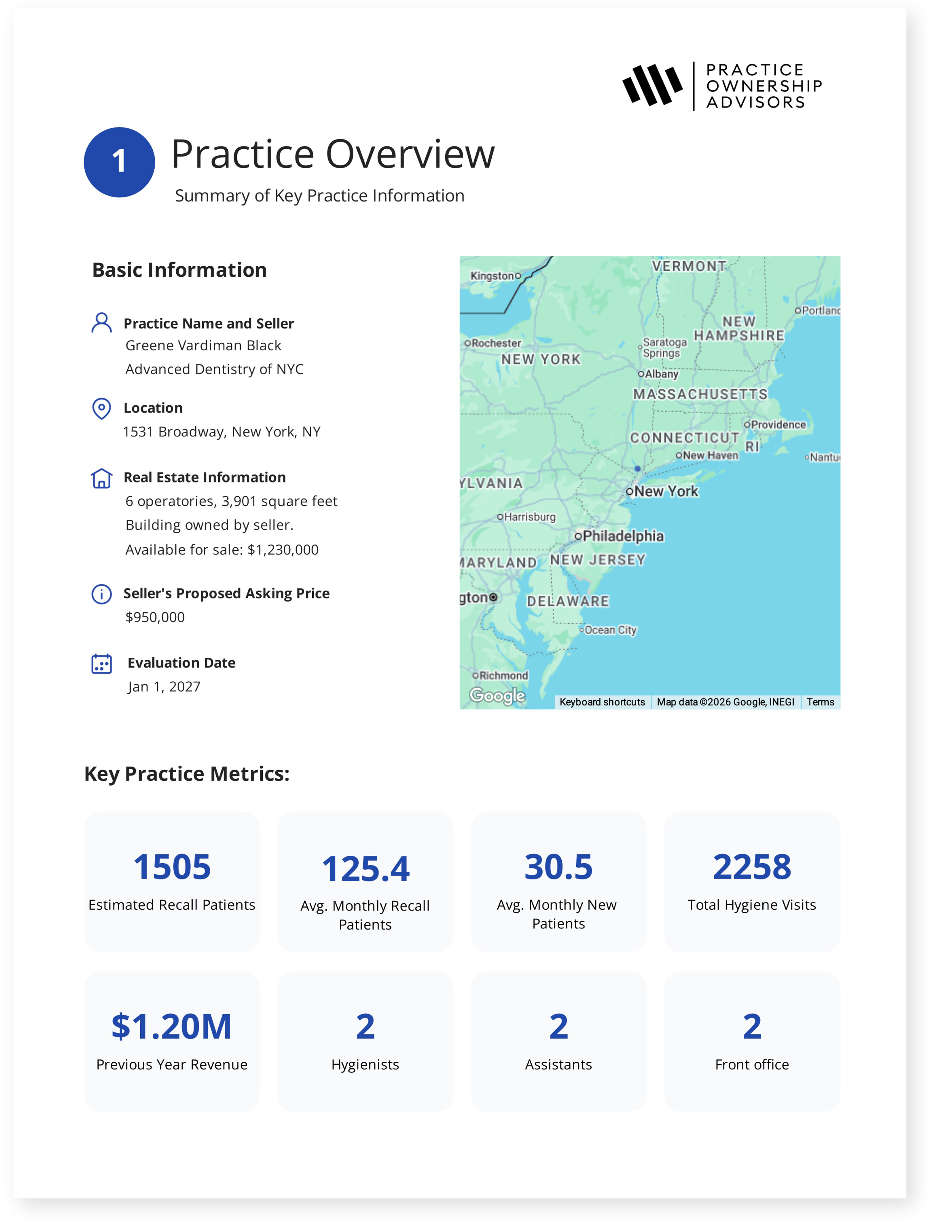

Practice Overview

What this shows the buyer

This section provides a clear snapshot of the practice as it exists today.

It establishes the baseline context for the evaluation, including location, size, staffing, patient base, and headline metrics. This allows buyers to understand what type of practice they are evaluating before interpreting performance, projections, or risk.

Executive Summary & Opportunity Assessment

The decision making view

Buyers receive a clear summary of cash flow a different production levels, recall patient analysis, and asking price.

What matters most

Where risk exists

Whether the opportunity supports their ownership goals

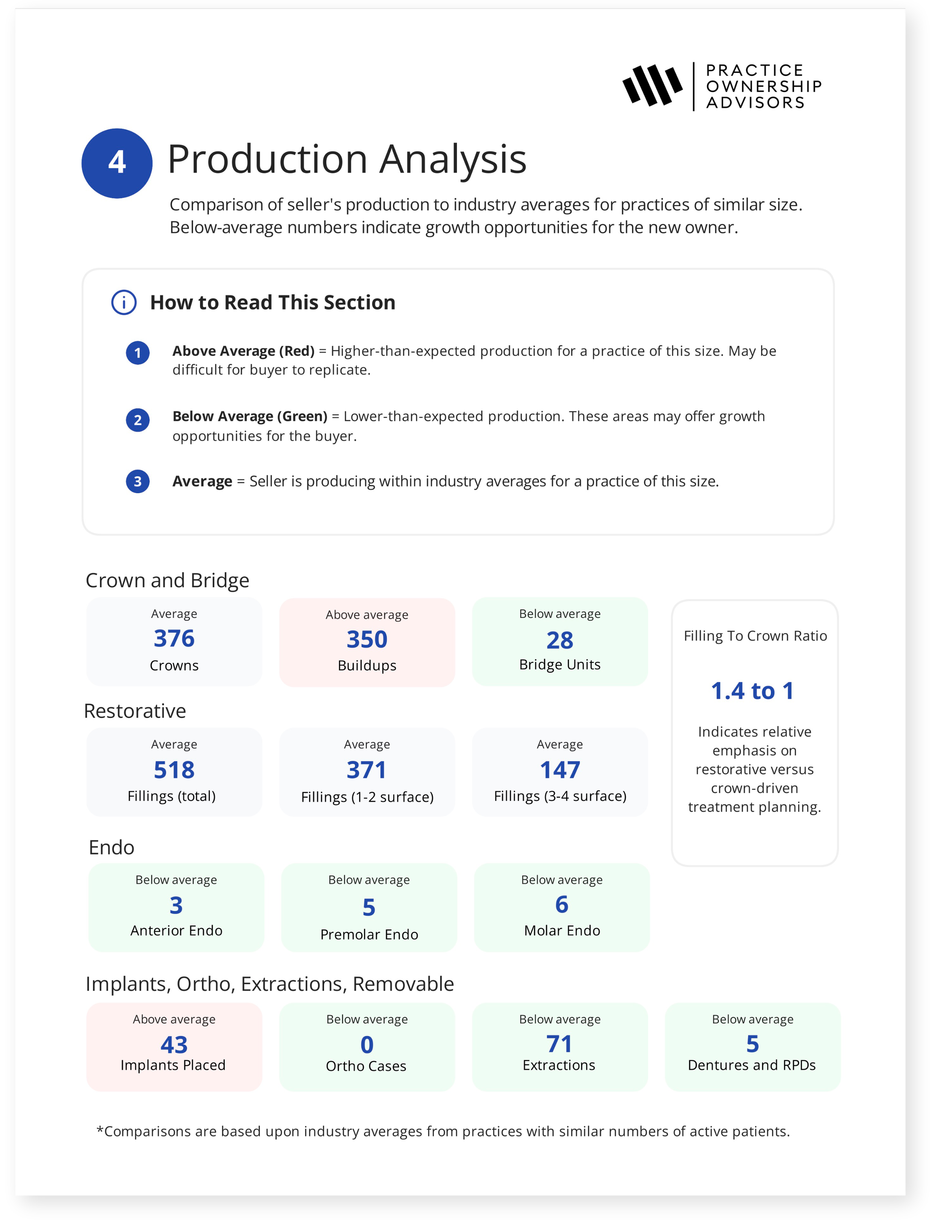

Production Analysis

How we evaluate transferability

This section compares the seller’s production by procedure to practices of similar size and patient base.

The objective is not to judge performance, but to identify where income may be difficult to replicate and where real growth opportunity may exist for a new owner.

Above-average production can signal seller-dependent income. Below-average production can signal untapped potential.

This is where we begin separating reported performance from transferable performance.

Additional Sections

Based on the practice and transaction, additional sections commonly included in the report may address topics such as:

Patient number validation and hygiene utilization

Detailed production by procedure and ADA code

Expense structure and fixed cost assumptions

Cash flow modeling under different buyer production scenarios

Purchase price affordability and debt service sensitivity

Operational constraints and growth limitations

Staffing structure and transition considerations

Included sections vary based on the practice and the buyer’s situation.

Verification And Due Diligence

During this stage, we help buyers confirm that the clinical and operational assumptions made earlier hold up in the real world.

This includes verifying how dentistry is actually being delivered, how the practice is staffed and scheduled, and whether the information provided by the broker and seller accurately reflects day-to-day operations.

Remote verification support is included in every engagement and is designed to help buyers interpret diligence materials, identify inconsistencies, and understand which findings matter most before contingencies expire.

Optional: In-Person Verification Site Visit

For buyers who want additional support, we also offer an optional in-person verification visit.

This includes a personal walkthrough of the practice to help verify clinical workflows, operational realities, facility constraints, and transition considerations that are difficult to assess remotely.

Service Fee:

$9,995 flat fee

Paid at the start of the engagement.

Includes:

Practice Evaluation Support to help identify the right opportunity.

Negotiation Structuring for any practice you choose to pursue.

Verification during due diligence once a practice is under contract.

Closing and transition readiness support through closing.

Direct access during the engagement, including scheduled decision calls at key milestones and email support for clarification between calls.

Optional:

In-Person Verification Site Visit: A guided walkthrough of the practice during due diligence to help verify clinical, operational, and facility conditions. Fees vary based on travel requirements and timing.

The engagement is structured to provide thorough support whether you are evaluating a single practice or navigating multiple opportunities.

How to get started:

The first step is a brief introductory call to determine whether buyer-side representation makes sense for your situation. This is a short, screening conversation focused on fit and timing, not a practice review or advisory session. Not every inquiry proceeds. If it looks like a good fit, we’ll outline next steps and what a full engagement would involve.

Frequently Asked Questions

-

This service is for dentists who are serious about buying a dental practice and want independent, buyer-side guidance before making a six- or seven-figure commitment.

Most clients are:

Associates preparing for their first purchase

Dentists evaluating multiple practices and unsure which one actually makes sense

Buyers who want to avoid overpaying or inheriting hidden operational problems

Dentists who value decision clarity over speed

If you are looking for someone to sell you a practice, find listings, or push a deal to closing at all costs, this is not the right service.

-

We do not act as a broker and we do not represent sellers. That distinction is intentional and important. Brokers are hired by sellers, paid by sellers, and incentivized to move transactions toward closing. Our role is different. We work exclusively for buyers, and our guidance is not influenced by listings, commissions, or deal outcomes.

That said, many clients come to us before they have identified a specific practice, and we welcome that. Early in the process, we help buyers think strategically about where to look, how to approach brokers, and how to position themselves as credible, serious buyers. We also share guidance on outreach strategies, timing, and common mistakes that cause good opportunities to be missed.

In some cases, this early work leads to off-market opportunities through professional networks or direct outreach. While we do not market practices or source listings, we help buyers create the conditions that make strong opportunities more likely to surface.

Our role begins with evaluation, but our value often starts earlier by helping buyers approach the search process thoughtfully and intentionally.

-

We start by gathering practice documents and a short intake questionnaire so we understand the opportunity and your goals. We then evaluate the practice from a clinical, operational, and financial perspective, focusing on how it is likely to perform under new ownership, not just how it performed for the seller.

Each evaluation results in a written Practice Evaluation Report that stands on its own as a decision tool. The report highlights true profitability, key drivers, risks, assumptions, and tradeoffs so you can decide whether to pass, continue evaluating, or move toward an offer without relying on guesswork or momentum.

-

This engagement is designed to support evaluation across multiple opportunities until the right practice is identified.

To preserve analytical depth and turnaround time, we evaluate up to one practice per week during the active engagement. This is a quality safeguard, not a cap on total evaluations, and it allows us to give each opportunity the attention it deserves.

-

We do not make decisions for you, but we provide clear, objective guidance so you can make informed decisions with confidence.

In some cases, that means recommending you move forward. In others, it means advising caution or recommending you walk away. Our role is to help you understand the risks, assumptions, and tradeoffs so you can decide what makes sense for your goals, experience level, and tolerance for risk.

-

Once an offer is accepted, the focus shifts to verification during the due diligence period.

We help you prepare for the site visit, understand what to observe in the practice day to day, verify whether reported numbers align with reality, assess the condition of the practice, and identify likely expenses after closing. The goal is to determine whether anything discovered materially changes the original decision before final commitments are made.

-

In-person verification visits are available as an optional add-on and are priced separately based on location and timing.

Many buyers find that structured guidance before the visit and interpretation afterward are sufficient. Others prefer an in-person visit for additional confidence. We help you decide what makes sense based on the specific practice and your experience level.

-

Once financing offers are received, we help you compare options, understand key terms, and evaluate how different structures affect cash flow, risk, and flexibility.

We also explain what matters versus what is largely noise, so you are not overwhelmed by lender jargon. We do not replace your lender, CPA, or attorney, but we help you understand the decisions you are being asked to make and the tradeoffs involved.

-

The base engagement includes up to twelve months of advisory support, which is typically more than enough time to evaluate multiple practices and complete a transaction.

If additional time is needed, optional extensions are available. The goal is to give you enough runway to make thoughtful decisions without rushing.

-

That can be a very successful outcome.

Walking away from the wrong practice can save hundreds of thousands of dollars and years of frustration. Many clients consider this service valuable even if they ultimately choose not to buy, because it helped them avoid a costly mistake and clarified what they are actually looking for.

-

Brokers represent sellers. Their role is to market the practice and move the transaction toward closing.

We work exclusively for buyers. Our role is to identify risk, challenge assumptions, and help you make informed decisions before irreversible commitments are made. We are not incentivized by listings, commissions, or transaction outcomes.

-

Most clients evaluate this service in the context of the size of the decision being made.

Avoiding overpaying, identifying risks early, or buying a practice that truly supports long-term income and lifestyle goals often outweighs the cost of the engagement many times over. One good decision or one avoided mistake can easily justify the investment.

-

That is completely fine.

Some clients engage early to learn what to look for and build decision confidence. Others are actively pursuing a purchase. We adapt to your timing within the scope of the engagement and focus on helping you make better decisions whenever opportunities arise.